Ensuring customer satisfaction is vital to the success of every business. Oftentimes, this includes handling customer complaints from angry consumers. However, learning tactics for handling upset customers is simple and possessing these skills will make you a much more valuable employee. Here are my favorite 10 tactics in handling customer complaints. 1. Be an active listener.…

Blog

4 Reasons Why Small Businesses Need to Accept Credit Cards

Small businesses may not see investing in credit card processing as an essential aspect of their business in the beginning, but the truth is that small businesses need to accept credit cards. With small profit margins, paying out a percentage of each transaction may be too crucial to the success of your business. However, adding…

Fraud Prevention Techniques for Card-Not-Present Merchants

Instabill works with both card-present and card-not-present (CNP) merchants every day. However, CNP merchants must take extra precaution against fraud exposure and associated losses. Follow our fraud prevention techniques to avoid fraud for CNP transactions and protect your online merchant account. Make sure you obtain an authorization from the cardholder. Verify the card’s authenticity. Ask the…

Instabill Merchant Accounts for Educational Programs and Software

Work-from-home educational software is becoming quite popular. It is very convenient and much more realistic for some people to have the luxury of working from home. For this target market, finding an honest, reliable source of educational software can be difficult. However, honest merchants will attract honest customers. Due Diligence Background Checks with Instabill At…

Increase Your E-Commerce Sales with Mobile Commerce Optimization

The question of where people most frequently shop has been critical to the success of businesses, investors, banks, and governments for decades. With the advent of the Internet and credit cards, the e-commerce industry revolutionized business success. New players have entered the field—namely website designers, hosting companies, and Internet payment service providers. Welcome to the…

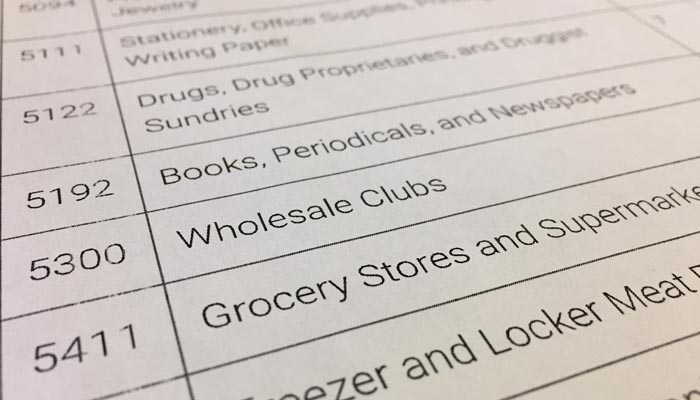

Merchant Category Code (MCC) Basics

Businesses are required to classify their industry by using a merchant category code, or MCC, in connection with a payments system. When a merchant account is set up to accept credit card payments from customers, the acquiring bank will require a business to use the correct MCC. Credit or debit card processors, such as Visa…

An In-Depth Look at Credit Card Processing Methods

An authorization hold—also know as a card authorization, pre-authorization, or pre-auth—is when a customer’s issuing bank authorizes a debit or credit card transaction and holding the balance as being unavailable. The transaction remains in this state until the merchant clears the transaction. This is also known as capturing or settling the transaction. With debit card…

Credit Card Processing for Financial Service Firms

Cash advances, stock trading, debt collection, credit repair—these are just a few sectors within the financial services industry. Traditional financial service firms provide clients with face-to-face consultations. You meet with your clients in an office, assist them with their financial needs, and they pay you as they leave. Nowadays, you have the option of allowing…

Ensuring Smooth Credit Card Processing

As a merchant, you know that the entire e-commerce process consists of details—purchasing goods, keeping track of it, selling it, shipping it, and answering customer inquiries. The list is extensive. Here are a few tips that can help ensure a smooth credit card processing experience. Chargeback Prevention Chargebacks are one of the easiest ways to…

Tech Support Merchant Accounts for Indian Startups

India has been in the news left and right this year and for good reason too. The country’s e-commerce industry is taking flight—and Indian students studying abroad are flying home after graduation. In fact, startup businesses are the primary role in India’s e-commerce boom. According to FirstPost.com, “Venture Capital firms have invested $363 million across…