Businesses are required to classify their industry by using a merchant category code, or MCC, in connection with a payments system. When a merchant account is set up to accept credit card payments from customers, the acquiring bank will require a business to use the correct MCC.

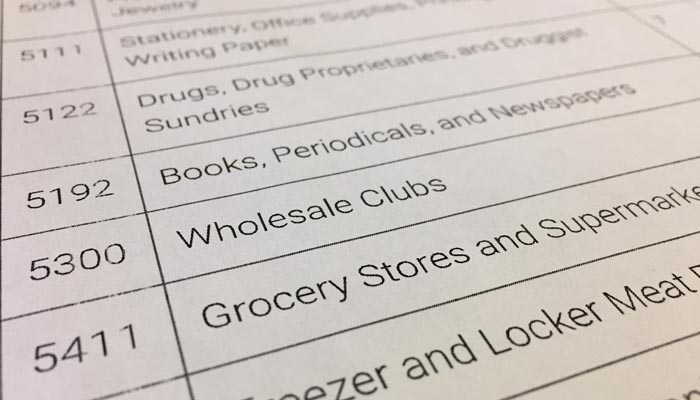

Credit or debit card processors, such as Visa and MasterCard, use approximately 600 codes to identify the industries they serve. Customers purchasing goods and services with a charge card might notice a four-digit code on their statements; this reflects the MCC. After a customer pays for a restaurant meal with a Visa card, for example, the merchant transaction will be noted with the merchant category code 5814. When a customer pays for a meal using a MasterCard, however, the letter “F” will appear next to the numerical code.

The correct codes help establish accurate fees

In order to avoid misclassifications, merchants need to describe their products and services accurately when first setting up a payments system. MCC classifications are important because banks use them to establish the interchange fees paid when a transaction is processed.

The correct code generally reveals whether a business is paying a fair fee for processing a transaction. Other merchants within the same industry could be paying a lower fee. The discrepancy, however, could be caused by a simple error, such as a business using an incorrect MCC. Companies that offer a variety of goods or services may at times choose a code that reflects the majority of their sales.

Industry classifications define products and services

An accurate merchant category code defines what a business can sell through credit card payments. An MCC also determines whether a business needs to report its transactions to the IRS at the end of each fiscal year. The sale of goods or merchandise does not require reporting, but generating revenue by providing services requires filing an IRS 1099 form.

Some merchant service providers have strict rules regarding the assignment of MCCs. The bank may require a business to sell only one type of product or service that falls within its category. A transaction for goods or services classified outside of the category could cause a sale to be rejected. Compiling an inventory of each product or service offered and cataloging them by their relevant MCC descriptions can help build a more reliable and rejection-free payments system.

A merchant’s business might be viewed as a risk

Businesses that sell products or services with a reputation for cardholder disputes could possibly face challenges when setting up a new merchant account. While a business may be able to easily set up a payment gateway through a merchant service provider, some banks may choose to reject a customer’s credit card transaction if the sale falls under a high-risk MCC category.

Typical industries classified as “risky” by some banks include online-only sales for products such as tobacco, cannabis or concert tickets. These products can be legally purchased in many jurisdictions, but the risk associated with a sale comes from a bank’s history of customers that have disputed a purchase.

By claiming that a purchase was not authorized, a cardholder has the right to request a refund through a chargeback. As an example, a teenager might use his or her parent’s credit card to purchase tobacco products from a website; this could reflect a sale not made with the card holder’s permission.

Codes can help attract customers

Customers also receive a benefit from a business using accurate merchant category codes. The codes track purchases and calculate how much a customer is earning toward a credit card’s promotional rewards, such as loyalty or bonus points. An incorrect code assignment could prove frustrating for a customer who prefers to make purchases from a business that can add to their credit card issuer’s reward incentives.

When a business provides several different products and services, having separate merchant accounts may help categorize each purchase. A customer who is motivated to make purchases by earning reward points could use one card to make several different purchases from a website that offers a variety of products and services.

More than one merchant account can help solve transaction issues

Many businesses operate several divisions under one larger company umbrella. Unless each business section offers the same product or service, it can be beneficial for each division to have its own merchant account. This can help differentiate which revenue streams are most profitable.

A restaurant, for example, could have an onsite gift shop, but cannot process a blanket transaction for both sales areas. The business’s owner could, however, set up different merchant accounts, each with a separate MCC, to differentiate revenue from customers who purchase meals and those who buy items from the gift shop.

With each unrelated product or service associated with its own separate merchant category code, an acquiring bank can effectively process a variety of transactions. Not only does an accurate MCC result in easier accounting, it also helps customers earn their card-use incentive rewards.

Instabill provides merchants with account protection guidance and advice

Opening a retail location where customers can make in-person credit card transactions may help some high-risk merchants generate sales. When high-risk products are purchased through a website, however, the merchant’s data submitted to the card’s issuer may cause the payment gateway to reject the transaction. A merchant account could possibly face termination if unapproved goods or services are sold through credit card transactions.

Instabill’s merchant customer service team can help. Contact us for guidance on how to correctly identify products or services through merchant category codes.