High risk merchants who need a merchant account often fall for empty promises like ludicrously low rates and fees, approvals on the spot or free use of a payment gateway. Sometimes shopping for a merchant account can eerily resemble the seven deadly sins: Pride (The merchant thinks he can get lower rates and fees) Greed…

Category: Merchant Accounts

The Best Third Party Merchant Account Providers Have One Thing in Common

When choosing among third party merchant account providers, there is one simple quality merchants need to keep in mind: Experience. We’ve built a legacy at Instabill. And it is our network of merchants and partners who benefit from that legacy. Being a third party merchant services provider of high risk industries since 2001, we know…

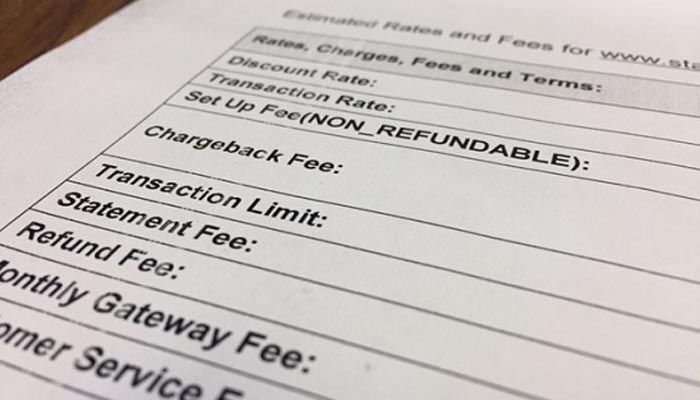

Merchant Account Fees: Why We Charge What We Charge

On a typical workday, we’ll take 60-80 phone calls, e-mails and live chats asking what our merchant account fees might be for this industry or that business. We wish it was a simple, one-size-fits-all answer, but it’s far from it. Frankly, we don’t know. E-commerce businesses are like fingerprints or snowflakes: They’re all unique. Hence,…

Our Process for Offering High Risk Credit Card Processing

We don’t offer high risk credit card processing to every merchant who contacts us. Far from it. In fact, we probably turn away between 15-20 percent of the more than 100 inquiries we receive each week for a number of reasons: The merchant poses too high a risk — we cannot find a solution. Volume…

Why Cross Border Acquiring Has Become More Difficult

If you are finding it more difficult to get an offshore merchant account, you’re not imagining things. Recent regulation changes from Visa have made the cross border acquiring process a little more complicated for merchants who want or need to process transactions through an offshore bank. Complicated, but certainly not impossible. The cross border acquiring…

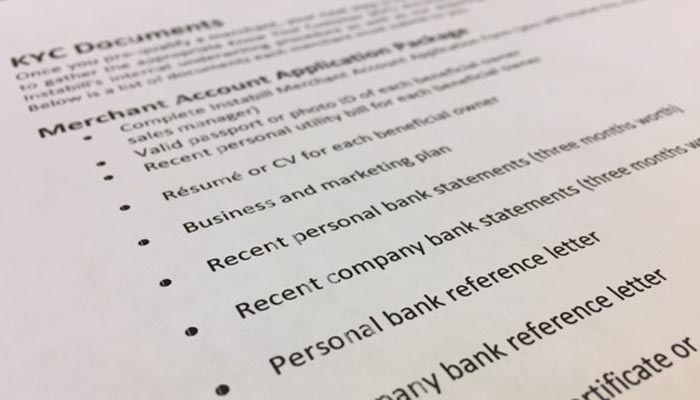

Where Offshore Merchant Account Documents Differ From Domestic (Part 2: Offshore)

As a high risk payment processor, we often need to find international and offshore banking solutions for merchants. Therefor, the application process requires a host of offshore merchant account documents. While it’s true that offshore merchant accounts have benefits that domestic counterparts do not – i.e., acceptance of high risk industries and higher volume caps…

Online Casino Merchant Accounts

International credit card processing solutions Fantasy sports & online gaming solutions Solutions for online poker and blackjack Finding approvals for online casino merchant accounts can be tricky for a handful of reasons. The key lies in partnering with international and offshore banks that have not only the payment processing solutions, but the regulatory knowledge…

Why We Need Certain Merchant Account Documents (Part 1: Domestic)

Of all the questions we are asked during the merchant boarding process, this one might be our favorite: ‘Why do you need my utility bill?’ Believe us when we say there is a method to our madness. We need a handful of merchant account documents when we board merchants – we call them KYC documents,…

Attention Payday Lenders: Less Than 48 Hours...

Payday lenders have less than 48 hours to share their opinions with the Consumer Finance Protection Bureau about its proposed reforms. In a nutshell, the Bureau is calling for all U.S. payday lending merchants to ascertain – before any loan is granted – that a borrower has the means to repay the loan in an…