As a high risk payment processor, we often need to find international and offshore banking solutions for merchants. Therefor, the application process requires a host of offshore merchant account documents.

While it’s true that offshore merchant accounts have benefits that domestic counterparts do not – i.e., acceptance of high risk industries and higher volume caps – applying for such is different than the applying for a domestic merchant account.

Different, but not overwhelming. And we’ll walk you through it.

The Offshore Merchant Account Documents We Need

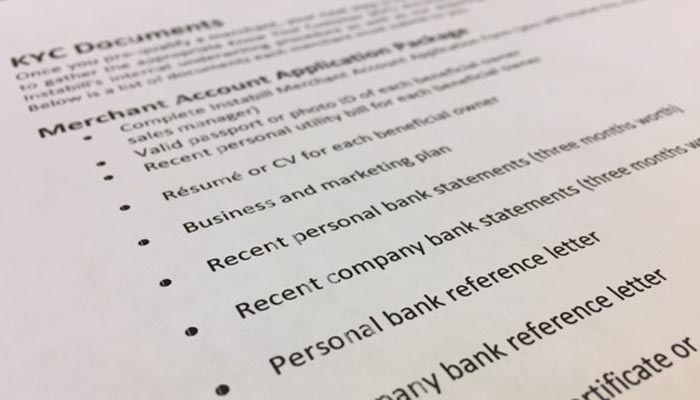

There are eight core KYC documents (know your customer) needed when applying for a domestic merchant account, which we recently blogged about. There are eight additional documents necessary for an offshore account – but each has its purpose. The domestic merchant account documents we need include:

- Acquiring bank application

- SS4 or W9 Document

- Photo IDs of Owners (10 percent ownership or more)

- Voided blank check

- Utility bill

- Business banking statements/Business bank letter

- Credit Card Processing Statements

- Website or Marketing material

We’ll Also Need…

The offshore acquiring banks with which we are partnered are more thorough in vetting and underwriting potential merchants. In addition to the eight items above, Instabill and our acquiring bank partners also require the following:

- Resume/CV for each beneficial owner: Shows the history of prior employment for each of the business’ owners.

- Business and Marketing Plan: We’d like to know how you intend to market and drive sales to reach monthly volumes.

- Personal Banking Statements: The most recent three months of personal bank statements are necessary along with business bank statements in the offshore application process.

- Personal and Company Bank Reference Letter: These articles are simply the banks ascertaining that you are in good standing and stability.

- Articles of Incorporation and Incorporation Certificate: These are documents filed with your government to legally document the creation of a company.

- Proof of Domain Ownership: We’ll accept a screenshot of your website’s administrative page when logged in. This is required to prove ownership of the domain.

- Suppliers Agreements: Suppliers agreements are necessary to show who your supplies are coming from. If suppliers agreements are unavailable, merchant must provide invoices of where you’re buying your products.

- Proof of Proper Business License (If such is required by merchant’s government): Many governments mandate licenses for certain industries, such as pharmaceuticals, loan brokerages and forex.

Live Merchant Account Support

Instabill merchant account managers don’t only help your business to begin processing credit card transactions, They’re on hand as your resource for the life of your offshore merchant account through Instabill.

We pride ourselves on live support by telephone (1-800-318-2713) or by selecting the live chat option below.