We’ve blogged frequently about the difficulty we have in finding payment processing solutions for debt collection merchants, especially recently. Sometimes we’ll get a pre-application from a collection agency merchant who buys debt for pennies on the dollar, and is looking to collect on it. We unfortunately have to break it to him: Of all the…

Category: Industry News

Attention Payday Lenders: Less Than 48 Hours...

Payday lenders have less than 48 hours to share their opinions with the Consumer Finance Protection Bureau about its proposed reforms. In a nutshell, the Bureau is calling for all U.S. payday lending merchants to ascertain – before any loan is granted – that a borrower has the means to repay the loan in an…

Same Day ACH: Understanding Phase 1

We had been waiting for Sept. 23, 2016 because – we feel – it is/was a monumental day for the payments industry: The first day of the first phase of same day ACH (Automated Clearing House) transactions; the beginning of the movement to a single-day settlement. With so many options for immediate payments, same day…

Debt Collection is About to Get Way More Difficult

If we had to choose which of the 90-plus industries we’re boarding increasingly less of, it would have to be debt collection. Over the last 3-4 years, acquiring banks – especially those here in the U.S. – are shunning merchants seeking payment processing for debt collection businesses. Much of the responsibility for that can go…

Why Our Offshore Banking Partners Approve What Domestic Banks Decline

We often receive quizzical looks and a series of questions when we advise a merchant to take their business to one of our offshore banking partners for credit card processing rather than one of our partners here in the U.S. There is a sense of hesitation at first, maybe a loss of familiarity, and we…

We Found Something Strange on This American Express Ad

The major credit card issuers are supposed to be pushing EMV credit cards, the new ones with the microchip, right? Is it not true that the major brands got together one day a few years ago to collectively form a plan to implement EMV chip credit cards in the U.S.? Isn’t our fair nation, after…

ACH Payments Continue Growth – Get Used to It

There were 24 billion ACH payments made in 2015 – about 1.3 billion more than there were in 2014 and the second straight year that ACH transactions grew by more a billion. To us, it’s not surprising. And a boatload of credit, pardon the pun, goes to NACHA, the governing body of ACH payments. In…

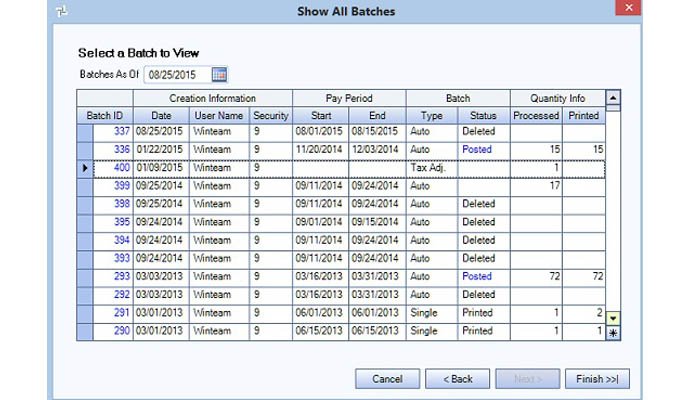

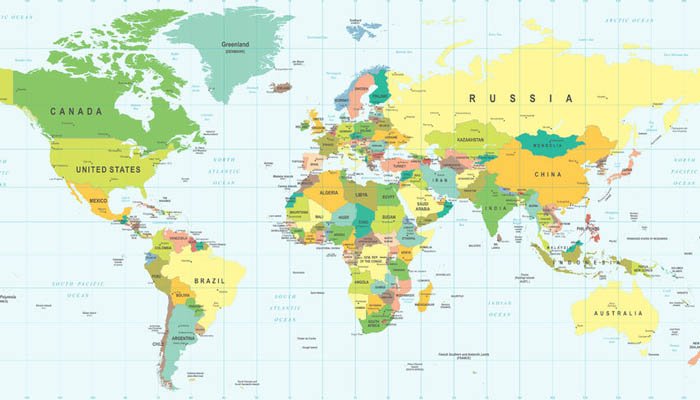

Why We Can’t Process Payments in Certain Countries

Every day, we get inquiries from merchants who need to process payments through their website. S/he could be offering a product such as shoes or a service such as tech support. As our account managers always do, they’ll ask the initial pertinent questions: Did you have a payment solution prior to contacting us? If so, was your merchant account…

EMV Payments After 10 Months: The Good and the Bad

August 1 marked the 10-month anniversary of EMV payments in the U.S. Like it or not, EMV is staying put. It’s been a trial by fire, and here are what we consider to be the positive and negative: The Negative: Vendor Shortage, Longer Lines, Chip & Signature Without question, the biggest downfall of the nationwide…

The Dreaded MATCH List (and What to Do)

Is it possible to come back from the MATCH list? Indeed it is, but not without a good amount of effort from a merchant. About once a month, we’ll get an inquiry from a merchant, recently placed on the MATCH list (also called the TMF list), looking for payment processing. We approach each merchant case…