I recently had an article published in the payments news periodical, The Green Sheet, entitled ‘Telltale Signs of Transaction Laundering.’ The idea for the story came to me when one of our merchant account managers was vetting the website of an applicant, didn’t like what she saw and subsequently refused the merchant’s request. Because I…

Blog

The Dreaded MATCH List (and What to Do)

Is it possible to come back from the MATCH list? Indeed it is, but not without a good amount of effort from a merchant. About once a month, we’ll get an inquiry from a merchant, recently placed on the MATCH list (also called the TMF list), looking for payment processing. We approach each merchant case…

Daily Fantasy Sports (Slowly) Making a Comeback – We Told You

We went out on a limb last March and predicted daily fantasy sports would make a comeback. We based this on three observations: DraftKings and FanDuel making in-roads in the U.K. DFS Legalization in both Virginia and New York (and many others considering) States realizing it is a new revenue stream The emergence of DraftKings…

Ever Heard of These High Risk Merchant Accounts?

We’re hoping this is the start of something. We can usually gauge the kinds of industry leads we’re going to see at the beginning of each month. We seem to draw plenty of tech support merchants, online travel businesses and web design/SEO companies that need high risk merchant accounts. Four days into August, however, and…

3 Connections Between Payments and the 2016 Rio Olympics

The Opening Ceremony for the 2016 Rio Olympics is two days away and an expected half-a-million consumers worldwide will descend upon ‘The Marvelous City,’ many of which will spend a small fortune on memorabilia, meals, event tickets, transport and apparel. And let us remember that Brazil is not only hosting the Olympic Games, but also…

FDA Regulations on E-Cigarettes Effective Aug. 8

Back on May 9, we blogged about the FDA regulations on e-cigarettes and the affect they will have on e-cigarette merchants. There are a host of changes the feds are imposing, such as: How merchants will need to apply to the FDA for licensing and permission to sell products. Merchants are prohibited from advertising their…

Attention Subscription Billing Merchants: Don’t Do This

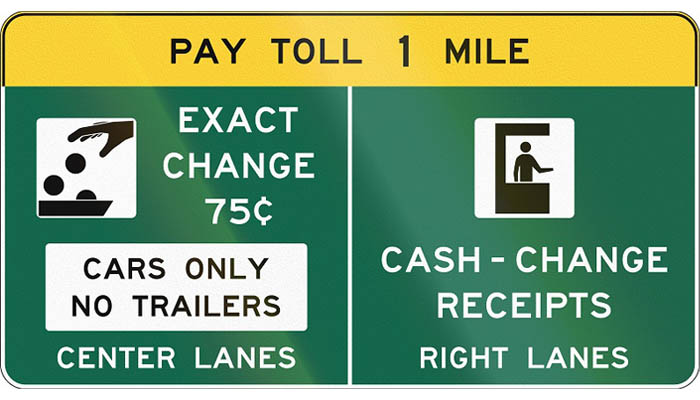

Each day when I drive to the Instabill home office in Portsmouth, N.H., USA, I pass through a toll booth. Rather than pay the $2 cash at the window, I have a transponder attached to my windshield that enables me to cruise through without going under 70 miles per hour. Toll collection is the consummate…

The Consumer Finance Protection Bureau: What to Expect in the Next Five Years

The Consumer Finance Protection Bureau turned five years old last week. Created as a result of the 2008 financial crisis and part of the 2010 Dodd Frank Act for financial reform, it has done some good things such as: Requiring mortgage lenders to ascertain a person’s income and viability to make good on a mortgage…

The Great Thing About Placing High Risk Merchant Accounts

We are all high risk merchants. And low risk merchants. And medium risk merchants, if such a distinction exists. And here is why we say that: We have plenty of partners with which we accept and refer businesses for payment solutions. Many of them are competing payment processors that only work with low risk, retail…

Small Business Hacking Getting More Common

This blogpost was originally posted on Instabill’s satellite website, Instabill.info, on June 12, 2015 with the help of Ed Black, a former PCI Director at Comodo, now a Territory Manager at Heartland Payment Systems. Ed Black says the worst thing a small business owner can believe is that his/her company is safe from hackers, simply…