Recently I read an article about e-commerce merchants who didn’t dispute chargebacks. Never dispute any. At all. Absorbed them. Paid whatever fines, did their best to remain under the 1 percent/100 per month threshold and washed their hands of them until the next month. After the first few graphs I asked myself, ‘How are these…

Category: Support and Services

Instabill Payment Processing FAQ Pages: Untapped Resources

We have long said how we pride ourselves on our customer support. When merchants, partners and prospects call our Portsmouth, N.H. offices, we answer and do our best to solve their inquiries. Recently, as we finalize a major redesign of our website, I came across our payment processing FAQ pages – seven of them actually…

E-Commerce Complaints: The 5 We Most Hear About

Recently we came across a news item revealing that the level of e-commerce complaints has risen 300 percent in the last three years. Whether that figure is accurate or inaccurate, 300 percent in three years is a massive jump. It’s not that bad online shopping experiences have suddenly become an epidemic. Simply, more and more…

3 Reasons Your Business Should Offer Check Payments

Check payments are so 1970s. The 1970s called. It wants its checks back. What’s longer than an EMV transaction at checkout? Paying by check. We’ve heard all the jokes and references how check payments are outdated. We’ve also heard all the misconceptions that checks are becoming obsolete. We disagree emphatically. Checks, especially digital and virtual,…

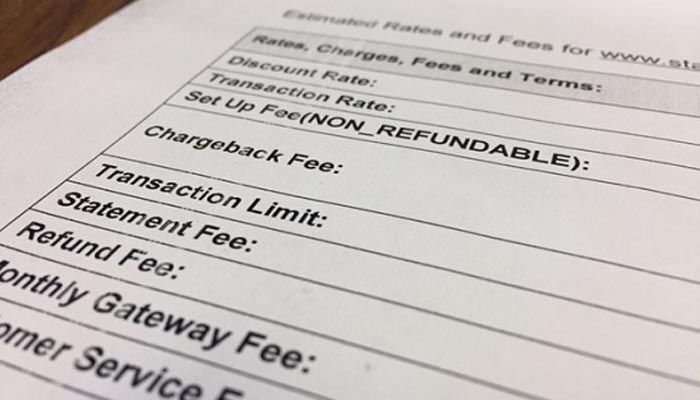

Merchant Account Fees: Why We Charge What We Charge

On a typical workday, we’ll take 60-80 phone calls, e-mails and live chats asking what our merchant account fees might be for this industry or that business. We wish it was a simple, one-size-fits-all answer, but it’s far from it. Frankly, we don’t know. E-commerce businesses are like fingerprints or snowflakes: They’re all unique. Hence,…

Our Process for Offering High Risk Credit Card Processing

We don’t offer high risk credit card processing to every merchant who contacts us. Far from it. In fact, we probably turn away between 15-20 percent of the more than 100 inquiries we receive each week for a number of reasons: The merchant poses too high a risk — we cannot find a solution. Volume…

Communication, Courtesy: This Should be Your Return Policy

Of all the gifts I bought my wife this Christmas, she ended up returning one: Ugg pajamas. The process was as efficient as it gets because of Ugg’s excellent return policy. In fact, Ugg shipped the pajamas as if it expected that I would return them: I received a prepaid shipping label, packaging and contact…

How to Fight Chargebacks? Start With Contacting the Buyer

The Chinese symbol for the word ‘crisis’ also contains the symbol for ‘opportunity.’ We love this way of thinking, especially this time of year. Because it’s chargeback season. Millions of merchants are gearing to fight chargebacks. The vast majority of holiday chargebacks take place in the first weeks of the new year. We know this…

Why European Merchants Need to Diversify Payment Technology

If a recent survey from our partner Worldpay holds true to form, European merchants are going to have to upgrade their payment technology to accept a number of different payment methods in the coming years. European consumers are going to be paying for their goods and services in several ways, says the survey: mobile phones,…

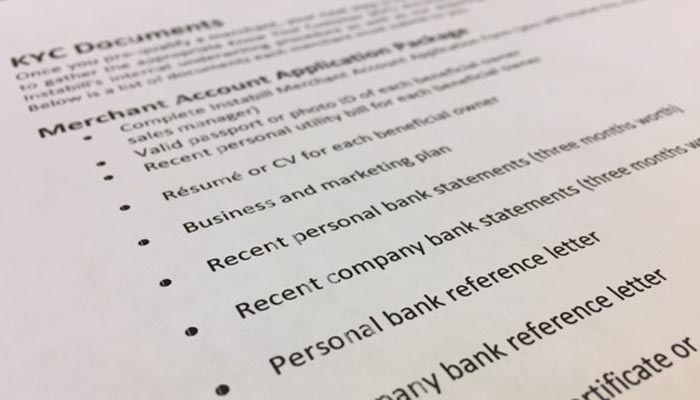

Where Offshore Merchant Account Documents Differ From Domestic (Part 2: Offshore)

As a high risk payment processor, we often need to find international and offshore banking solutions for merchants. Therefor, the application process requires a host of offshore merchant account documents. While it’s true that offshore merchant accounts have benefits that domestic counterparts do not – i.e., acceptance of high risk industries and higher volume caps…