About your billing descriptor

When you receive account details for a merchant account, one of the most important details you receive is your billing descriptor.

What is a billing descriptor?

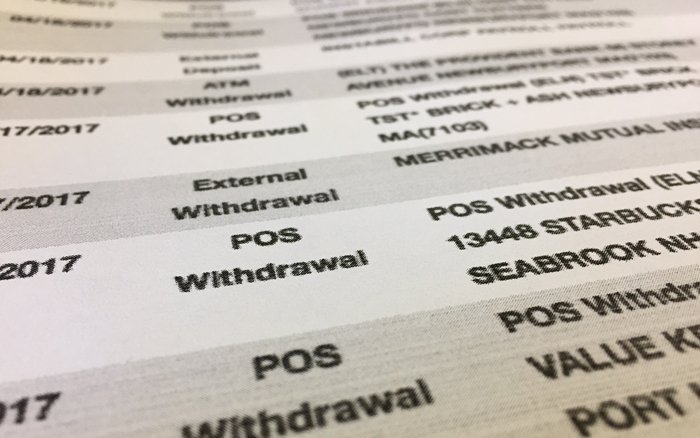

A billing descriptor (sometimes just called a merchant’s descriptor) is a short business description that appears on your customers’ credit card statements. The intent is to allow customers to easily identify or contact the business associated with the charge on their credit card.

This is a good thing. Chargebacks are often incurred when a customer doesn’t remember or recognize a charge, and giving your customers as much information as possible can help reduce chargebacks drastically.

What does a descriptor look like?

Descriptors come in a few different forms, depending on your account type. Most main descriptors are around 20-25 characters in length—sometimes this is referred to as the first line of a descriptor. Some banks allow you to use more space for descriptor information. However, some credit card statements may cut off anything past the 20-25 character mark. For this reason, it is important to get the most important information into the first line of the descriptor.

How can I reduce chargebacks by creating a customized billing descriptor?

If you have your own billing descriptor, it can usually be customized in whole or in part. With a few exceptions, it is very important to put a recognizable form of your company name in the first line of the descriptor. These exceptions are usually for merchants with customers who may desire discretion. If this applies to you, you may still be able to use some form of your company name, as long as it does not indicate what the product is. (You just might want to avoid plastering VIAGRASUPERSTORE across someone’s credit card statement!)

It is also a very good idea to put your customer service phone number in your billing descriptor to reduce chargebacks. That way, it’s easy for customers to contact you before they call their credit card company to initiate a chargeback.

Can every business use a customized billing descriptor?

Not right away. You may be required to use a standardized (non-customized) billing descriptor for a while, particularly if you are a start-up company or have no processing history. If this is the case, you will usually be able to select a billing descriptor that best matches your business. The conditions and descriptors will vary depending on your account— contact your account representative to ask about your options.

What else do I need to know?

Make sure that your customers see your billing descriptor before they see their bills. Expose customers to your billing descriptor repeatedly, in various places, so they readily associate it with your business when they see it on a credit card statement. If you only have one descriptor, you can place it on the bottom of every website page in the footer, or even incorporate it into your header.

If your online business uses multiple descriptors, ask your developer make sure the correct descriptor is displayed on the confirmation page (the page the customer sees after an order is processed), and in the confirmation email sent to the customer.

Additionally, it’s often a good idea to submit a small test transaction on a personal or business credit card in order to view the descriptor on your own credit card bill to make sure that everything is in order.

Your billing descriptor is key to preventing needless chargebacks—make sure you have it optimized to do just that!

Submitting your billing descriptor at ibddb.com is a good idea to avoid chargebacks due to customers not recognizing your billing descriptor.