Every single day, Instabill merchant account managers are approached by e-commerce startup merchants anxious to begin credit card processing so they can launch their businesses. It’s what we do and we love it.

The application process for acquiring the best merchant services and payment solutions for your startup business is more stringent than it was even 2-3 years ago.

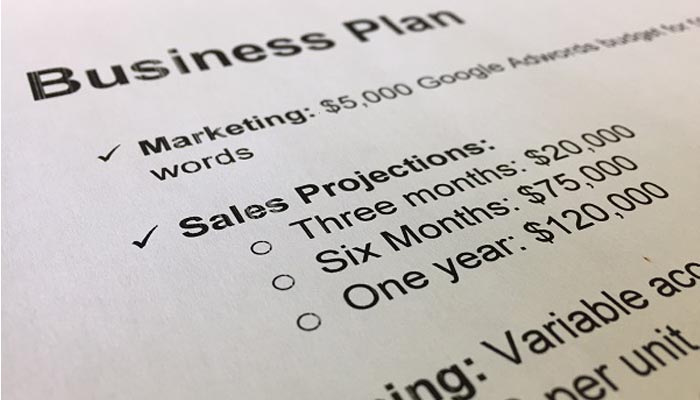

Acquiring banks want to see a detailed startup business plan that includes five key points we’ve listed below.

Why acquiring banks want to see a startup business plan

Simply put, acquiring banks want to vet and separate the bad actors from legitimate merchants.

The acquiring bank and/or the merchant account provider are taking a risk by offering their services. More than ever, banks are on guard against fraud and must ascertain startup merchants are offering legal and legitimate products and services before any approval is made.

Alas, here are the five points startup merchants need to identify and expand upon when applying for a merchant account:

1. How do you plan to market your product or service?

Acquiring banks need to know how you intend to drive traffic to your website, and the rationale behind the strategy. Popular marketing strategies include Google Adwords, e-mail campaigns or even direct mail.

2. What are your financial projections?

How much revenue do you expect to generate in the first three months? Six months? The first year? This is something the acquiring bank will need to know.

3. Your products and services and the pricing behind them

Firstly, all products and services must be legal and legitimate in the country (or countries) in which you plan to operate your e-commerce business. The reasoning behind your pricing scheme is equally important. Too often, our merchant account managers see pricing that makes little sense and shows signs of transaction laundering.

4. Two questions: What is your return policy and how can customers contact you?

We strongly advise that a clear and practical return policy and contact information – preferable a phone number and e-mail (even a live chat option) – be listed prominently on your website.

5. Security features and risk management

Late last year, we blogged about a Google update which boosted websites search rankings if the site was secure, i.e., had an ‘https’ address instead of the more common ‘http.’ For new websites and startups, we advise a website with secure sockets layers.

Merchants should also think about securing their transactions with 3D secure processing as e-commerce fraud continues to increase.

By including and detailing these five points in your startup business plan, your chances of obtaining a merchant account will increase 10-fold.

We’d like to hear about your startup

Instabill, which has offered e-commerce startup merchant accounts since 2001, is always up for a conversation about your business and the best payment processing solutions we can offer. A merchant account manager is available directly at 800-530-2444 Monday through Friday, 8 a.m. until 6 p.m. U.S. eastern time. Inquiries after business hours will be addressed the very next business day, guaranteed.