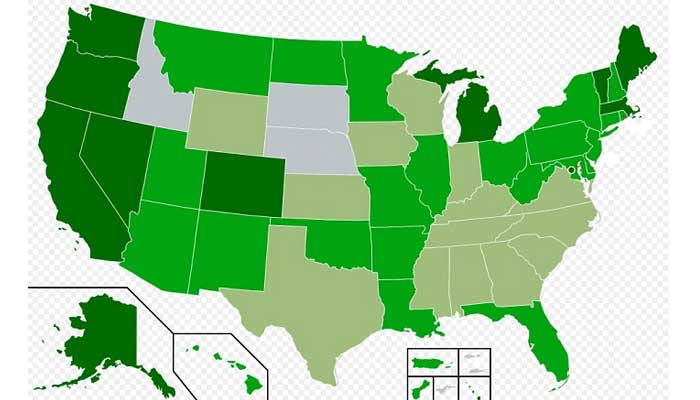

It’s a frustrating time for cannabis payment processors. We were among several at the Marijuana Business MJBizCon expo two weeks in Las Vegas. But it is also a very, very exciting time for those who wish to process payments for cannabis businesses, especially here in New England where Massachusetts (the home of several Instabill staffers) became the first state east of the Mississippi River to open recreational dispensaries in the town of Leicester and city of Northampton.

The frustration lies with the lack of sufficient, sensible and safe payment solutions for the cannabis industry. Dispensaries and retail storefronts, such as the newest ones in Massachusetts, continue to rely heavily on cash payments while some are able to accept debit cards. Credit card processing, however, is not an option – it’s a long story – but recent legislation is geared to changing that.

The STATES Act (Strengthening the Tenth Amendment Through Entrusting States), introduced on 7 June 2018, could arguably be the legislation that cannabis proponents – especially cannabis payment processors – have been waiting for.

It was an issue that was discussed with passion and generated plenty of cautious optimism at MJBizCon 2018.

5 massive changes — for the better — the STATES Act could make

We’ll save the best for last.

- Immunity for dispensaries, banks: One of the speakers at MJBizCon who struck a chord with us was Sundie Seefriend, the CEO of Partner Colorado Credit Union and Chairman of Safe Harbor, which offers banking resources for retail cannabis businesses. She said, because cannabis growth, sale and use are illegal by federal law, not only can the feds close down her credit union, she can be arrested and incarcerated at any time. Should the STATES Act pass through the House of Representatives, Congress and the president, it would exempt cannabis professionals in the legal states – dispensary owners, banks, credit unions and cannabis payment processors – from being prosecuted by the feds.

- Big changes in store for hemp: Since hemp is extracted from the marijuana plant, its value and use has been somewhat tarnished and underrated and, as a result, limited for what it can be used: building materials, paper and oils, mainly. In other words, since hemp comes from the cannabis plant, it is guilty by association. The demand and value of hemp, we feel, would surge in the event the STATES Act passes.

- How to regulate cannabis? Easy answer: Use alcohol laws as the initial legal framework for cannabis and adjust accordingly with time. Legal states have set limits as far as age; the number of plants; as well as sales, purchase and possession limits. Additionally, sales should be illegal outside of any legal dispensary, such as a park, shopping mall or any public place. The STATES Act addresses each of these issues.

- A scheduling conflict that needs attention: To categorize cannabis with far more powerful narcotics such as heroin, LSD and mescaline is simply inaccurate, unfair and borders on the absurd (pain killers such as fentanyl and oxycontin are Schedule 2 drugs). The STATES Act wouldn’t reclassify cannabis, but we feel it would draw the necessary attention to the need to reclassify to a Schedule 3 (morphine, cocaine), schedule 4 (xanax, valium) or even de-schedule.

- Legitimate banking services: It’s no secret that most banks refuse to offer their services for cannabis and cannabis-related businesses since possession, sale and growth remain illegal under federal law (most banks are connected to the Federal Reserve). However, under The STATES Act, banks could offer proper merchant accounts for cannabis businesses despite the plant remaining illegal under federal law.

The result would mean many benefits:

- Robust, streamlined banking leading to full transparency of money trails from seed to sale, through credit and debit card payments.

- Dispensaries operating safer, no longer with the burden or fear of storing massive amounts of cash or the risk of robbery — by employees and criminals on the outside.

- Accurate tax revenue — dispensaries no longer arduously paying taxes in cash.

We feel The STATES Act would be a major victory, not just for cannabis payment processors like ourselves, but for everyone involved.

The STATES Act: A boon to cannabis payment processors

In times of conflict resolution, it is rare to find a solution in which everyone involved wins. With The STATES Act, however, that is indeed the case, particularly for cannabis payment processors, who would be able to offer the merchant account solutions that are so desperately needed.

As we hope for the approval of The STATES Act, Instabill currently has two payment processing options for marijuana dispensary merchants:

- A debit card solution connected to customer and patient bank accounts, enabling for easy funding and payment.

- A digital currency solution in which merchants can offer both a crypto currency ATM and POS device at checkout, enabling customers and patients to easily pay in either form.

To find out more about out cannabis payment processing solutions, speak one-on-one with a merchant account manager at 1-800-530-2444.