On a typical workday, we’ll take 60-80 phone calls, e-mails and live chats asking what our merchant account fees might be for this industry or that business. We wish it was a simple, one-size-fits-all answer, but it’s far from it.

Frankly, we don’t know.

E-commerce businesses are like fingerprints or snowflakes: They’re all unique. Hence, our merchant account managers will engage prospective merchants in a conversation, so that they can learn more about the merchant and his/her business.

We Want to Know About Your Business

While all merchants come to us with a plethora of questions, we’ll have some too:

- What are you selling?

- Do you have payment processing history?

- What’s your expected volume?

- What is/was your chargeback frequency?

With your honest, forthcoming answers to the above, we’ll have an accurate quote for you within two business days.

When Merchant Account Fees Will Cost a Little More

Because of our long history in high risk payment processing, Instabill often attracts merchants who may have imperfect credit, flawed processing history or may even have been MATCH listed. In these cases, your merchant account fees will cost a little more, because our company and the acquiring bank with which we align your business need to protect the risk we invest in your business.

Remember, however, with consistent improvement in your credit and financials, we’ll negotiate your fees in due course.

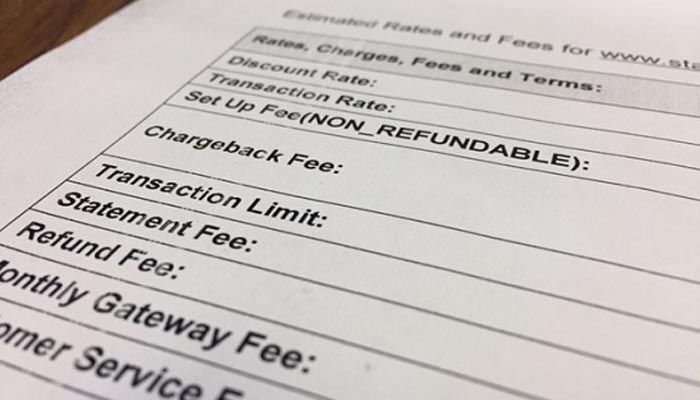

Merchant Account Fees You May Incur

Merchant account fees are variable according to the acquiring bank with which we match your business. Below is a list of fees you could be subject to:

- Per Transaction fee: A small fee, usually around $0.30 per transaction, that pertains not only to every sale, but each refund and decline.

- Discount Rate: What the merchant pays for transactions that comes out of a merchant’s daily or weekly settlement.

- Merchant Account Registration fee: The fee charged to merchants when registering their business in a different country.

- Monthly Statement fee: A nominal fee charged by your acquiring bank for e-mailing or posting your monthly bank statement.

- Chargeback fee: A fee charged by the acquiring bank for every chargeback.

- Refund fee: A fee charged by the acquiring bank for every return.

We’ll Walk You Through it

Merchant account fees can be a lot to take in, but Instabill’s merchant account managers will take you through it. We don’t just help get your business begin accepting payments, we remain on hand as consultants to make certain you succeed and thrive.

We’re available direct by calling 1-800-530-2444 or by selecting the live chat option below.