We read recently that credit card processing giant WorldPay, also a longtime acquiring banking partner of ours, is in the testing stages of a credit card equipped with a dynamic, changing CVV code. We think it’s a terrific idea that would transform the business of e-commerce merchant services and significantly secure online transactions that are so vulnerable today.

Since Instabill is in the business of providing the best merchant account solutions to high risk merchants, we are all too familiar with the struggles online merchants have with all things fraud and chargebacks. Mitigating fraud has become as much a part of e-commerce entrepreneurship as processing orders and making payouts. The chargeback climate has forced e-commerce merchants to rethink their mitigation and customer support schemes.

We’ll be curious as to what WorldPay finds once testing is complete. We think they’re on to something here: a viable solution to fight the two biggest threats facing e-commerce merchants.

On a personal level, I wish dynamic CVV codes were in existence three years ago when my credit card data was used fraudulently, nearly leaving me on the hook for a $1,600 purchase I did not make.

How a Dynamic CVV Code would’ve helped me

On a Sunday afternoon in January of 2015, my credit card issuer telephoned me to ascertain I had just made an online purchase of a Dell desktop computer valued at more than $1,600.

I most certainly did not.

My card issuer then went to work to investigate the fraudulent purchase, and immediately removed the $1,600 from my account, for which I was grateful. For now. Two weeks later, my card issuer contacted me once more to explain that the Dell computer merchant examined the transaction and deemed it was a legitimate purchase. I reiterated that it was not me, that I seldom used that particular card (I actually keep it in a sock drawer…for emergencies), and that it was inconsistent with my buying patterns, to say the least.

I asked my issuer where the computer was shipped (a small town in the midwest). I then asked her to look at my address (a small city in New England). Fortunately, she saw the point I was making and I was off the hook for committing friendly fraud. Soon after, I started receiving promotional items in the mail from Dell, addressed to someone other than me. I phoned my issuer and gave them the name of the person and inquired about the status of the investigation (as it was ongoing, they were unable to share any information).

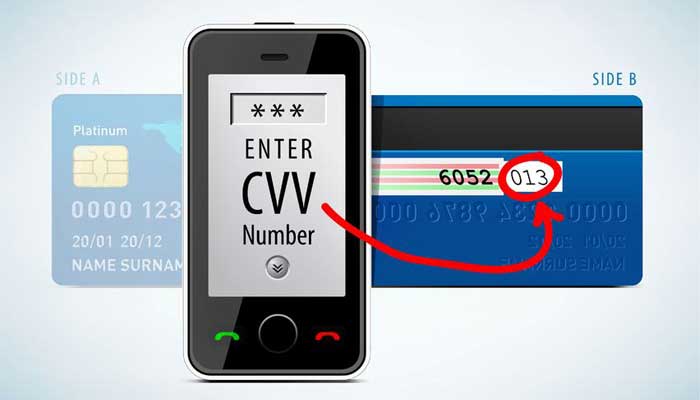

Thus, here is how a dynamic CVV code would’ve helped me: I am fairly certain that the recipient of the Dell desktop purchased my credit card data on a rogue website. Since the CVV code changes periodically, the fraudster would not have been able to complete the purchase of the Dell desktop. The sole purpose of the CVV code on a credit card is to ascertain the person making a purchase is the actual cardholder. The fraudster would have been unable to provide the correct digits of the CVV to complete the purchase.

How a dynamic CVV can help in a chargeback dispute

Credit card numbers with CVV codes have been available on black market websites (such as the since vanquished Rescator.cc) practically since e-commerce began in the mid- and late 1990s. Currently, anyone can purchase the credit card information – including the CVV codes – of unknowing consumers for cheap on the dark web. When the consumer has his/her actual credit card in possession, the changing CVV code renders stolen credit card information practically useless.

Imagine the benefits for the e-commerce merchant services industry. There would be far fewer instances of:

- Credit card fraud: When credit card information is stolen in a data breach, the fraudster would be unable to provide the most recent CVV code, since it changes.

- Friendly fraud: How could the fraudster have known the CVV code if they did not make the purchase?

- Chargebacks: We think it would elicit more/better communication between merchant and consumer.

3 issues card brands may encounter

As an e-commerce merchant services provider, we’re pulling for WorldPay because we feel oft-changing CVV codes is an exciting viable solution to all things related to credit card fraud. Here are three theories on the effects we think changing CVV codes will have:

- Cost of a Dynamic CVV credit card: Replacing credit cards now costs an issuer on average just below $2 per card. Replacing credit cards with dynamic CVV codes is far more expensive – between $15-$17. However, if the purpose of dynamic CVV credit cards holds true, the card issuers will spend far less on replacements.

- A move to mobile credit card payments: In theory, a revolving CVV code could be more feasible and practical on a mobile phone than a credit card. We wonder if this would be the impetus for the card brands to push consumers to store their credit cards on their mobile phones.

- Lower the risk of certain industries: As a high risk e-commerce merchant services provider, there are certain industries that are known for high chargeback rates, such as subscriptions, tech support and nutraceuticals. Dynamic CVV codes, we believe, would lessen the chargeback risk for all of these industries, simply because the rotating CVV code puts more responsibility on the card holder.

The best e-commerce merchant services

If the testing of dynamic, revolving CVV codes on credit cards yields positive results, it could transform risk in e-commerce merchant services. For credit card processing solutions for high risk industries such as CBD, online pharmacies, nutraceuticals, kratom and more, we’re on hand Monday through Friday (8 a.m.-6 p.m.) U.S. eastern time for a one-on-one conversation at 1-800-530-2444.