We had an epiphany the other day, and it’s favorable news for high risk merchants. We wondered when was the last time we wrote about Operation Choke Point, the U.S. Department of Justice’s 2013 effort to deny electronic payment resources to certain high risk industries such as payday lending, guns and ammunition sales and telemarketing,…

Category: Industry News

Future of e-commerce payments: Friction, frustration

I have a feeling that the future of e-commerce payments is going to be like that Christmas of 2011 when I got my first iPhone. Frankly, I didn’t know what to do with it. I put it back into the box and it sat there for months. And I waited nearly a year, when my…

Web Design Services are Thriving and There’s No End in Sight

We see a lot of trends in the business of merchant services, some for better, some for worse, such as: Banks abruptly halting services for certain industries Merchant account solutions once easy to find, now difficult Payment solutions once popular, now not so much One trend we’ve noticed the last three years is the constant…

Selling Beauty Products Online: A Burgeoning Industry

Back in April, we blogged about how subscription billing is alive and well, and will grow exponentially over the next five years. Why? It turns out that millennials love their subscriptions: razors, coffee and beauty products online. A recent news item on Shopify.com claimed the beauty products industry – online and physical stores – is…

2 (Different) Theories About the Future of Debt Collectors

Finding banking solutions for third party debt collectors is not easy. At the moment, we’re in search of new viable solutions here at Instabill. But a momentous turn of events in recent weeks is sure to have a significant effect on banks offering payment processing services for third party debt collectors. A recent lawsuit, Henson…

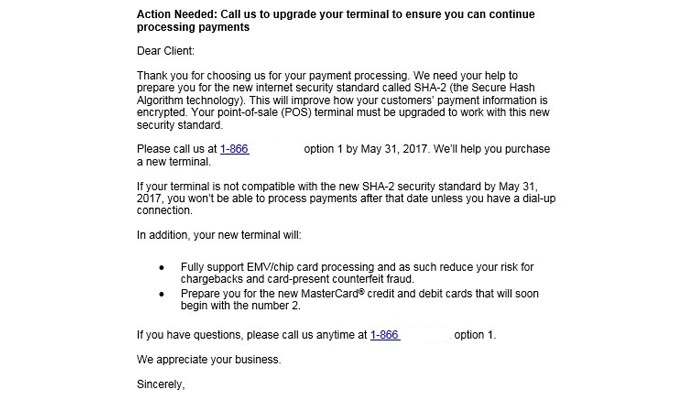

MasterCard 2 Series Causing Confusion Among U.S. Merchants

The voice on the other end of the line was frantic. ‘We just got this letter from our payment processor saying our credit card terminal won’t work after May 31. Do you know anything about this?’ Being in the business of payment processing, I get the occasional industry credit card inquiries. ‘Send me the letter,’…

Why Recurring Payments and Subscriptions are Here to Stay

I was guilty of thinking that the subscription model had seen better days. I know now that’s not true (forgive my Generation X ways). Merchants are getting creative with recurring payments models – it’s not just magazines, tolls and gym memberships that work well with subscription billing. Recurring payments, according to a recent study by…

Why the FTC is Watching Debt Collection Agencies

When the Federal Trade Commission decided to pay more attention to the practices of collection agencies, it really meant it. A recent news item in Consumer Affairs is all the evidence needed. Apparently, a company called American Municipal Services Corporation, a debt collection agency in Texas that services more than 500 municipalities and collects utility…

Why Cross Border Acquiring Has Become More Difficult

If you are finding it more difficult to get an offshore merchant account, you’re not imagining things. Recent regulation changes from Visa have made the cross border acquiring process a little more complicated for merchants who want or need to process transactions through an offshore bank. Complicated, but certainly not impossible. The cross border acquiring…

A Reminder for 2017: Credit Card Fraud is Alive and Well

We’re not big on New Year’s resolutions here, but there are a few things e-commerce merchants might want to take under consideration, if not already, for 2017 regarding credit card fraud. It’s going to get worse. As a reminder, with the U.S. migrating from credit cards with the magnetic stripe to those with the microchip,…