‘When is my tax return coming?’

It’s a common question this time of year. For some, the return never comes, and it’s the beginning of a long and painful headache called tax fraud.

Tax fraud victims, in most cases, usually don’t realize they have been swindled until after – sometimes long after – the crime has been committed. In short, the fraudster already has the personal information needed, files a return and disappears. When it comes time to file a legitimate return is when the taxpayer realizes s/he has been defrauded.

Whether you’re filing for a business or personally, the key to avoiding tax fraud is being proactive and knowing red flags. Below are five tell-tale signs of identity thieves attempting to steal your tax return (and your personal data) — things legitimate tax merchants would never say.

I can’t locate my tax preparer’s ID number at the moment

Tax preparers are issued an identification number by the IRS. This number should be easily accessible by the preparer. If the preparer doesn’t know it or can’t provide it, move on to an authentic tax professional.

Just sign this blank return, I’ll fill in the information later

If a tax preparer asks a client to sign a blank return, with the ‘assurance’ s/he will complete it later, this is a breach of IRS regulations. A professional tax preparer will never ask a taxpayer to do this.

My fee is a percentage of your return

Tax preparers usually either have set fees for compiling a tax return, or they may bill by the hour. It is unethical for a professional tax merchant to charge fees in accordance to the amount of your return.

I’ve set up a new account for your return

Consumers should never accept any alternative or destination for their tax return other than their personal or savings bank account. A tax preparer who offers another alternative likely wants access to your return.

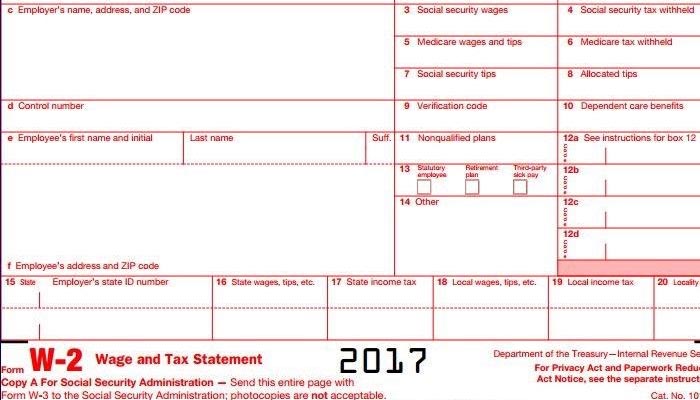

I don’t need your W2, just your last paycheck

Not only would a legitimate tax professional never say this, it is against IRS regulations. This is a sign that the tax merchant is trying to obtain personal data quickly, monetize it and disappear quick.

Tax fraud: 3 things victims should do immediately

Referencing our lead paragraph, your identity has been stolen and this is the beginning of a long and frustrating struggle. Credit experts advise three things to do immediately:

- Contact your credit card issuers and credit bureaus

- Contact the IRS Identity Protection Unit at 1-800-908-4490

- File a police report

Have you ever been a victim of a fraudulent tax scheme? We would love to know your story. Please leave a comment below.